What is Equity Mutual Funds ?

Equity Mutual Funds are a type of mutual fund that primarily invest in equity shares or stocks of publicly listed companies. The core objective of these funds is to generate long-term capital appreciation by benefiting from the growth potential of the stock market. Unlike fixed-income instruments, equity mutual funds do not offer guaranteed returns but have historically delivered higher returns over extended investment periods.

These funds pool money from multiple investors and invest in a diversified portfolio of equities, which may include companies from various sectors such as IT, pharmaceuticals, banking, FMCG, infrastructure, and more. The investment decisions are taken by professional fund managers who carefully analyze company fundamentals, industry trends, and market dynamics to identify high-growth opportunities.

Equity Mutual Funds cater to a wide range of risk appetites, offering options like large-cap funds for stability, mid-cap and small-cap funds for aggressive growth, and multi-cap funds for balanced exposure. Investors can choose to invest either through a Systematic Investment Plan (SIP) for disciplined and regular investing, or via a lump sum for one-time investments.

How Equity Mutual Funds Work

- If you’re new to investing, you might wonder exactly how equity mutual funds work. Here’s a simple explanation. When you invest in an equity mutual fund, you’re pooling your money with thousands of other investors. This pool of money is then invested in a diversified portfolio of company shares. Depending on the fund’s investment objective, the fund manager may focus on large-cap stocks, mid-cap stocks, small-cap stocks, or a mix of all three.

- The fund manager and their research team constantly monitor the market, analyze economic trends, company performance, and sector outlooks. Based on their research, they make buy or sell decisions to maximise returns and manage risk. For instance, if a certain sector like IT is booming, the fund manager might increase exposure to that sector.

- Equity mutual funds are generally open-ended schemes, which means you can buy or redeem your units anytime, unlike fixed deposits or other instruments that have a lock-in period (except ELSS funds). This liquidity is a huge plus for investors who want some flexibility.

Key Features of Equity Mutual Funds

| Feature | Details |

|---|---|

| Investment Type | Stocks / Shares |

| Risk Level | Moderate to High |

| Return Potential | High (Over long term) |

| Investment Horizon | Ideal for 3–5 years or more |

| Liquidity | High (can redeem anytime, except ELSS) |

| Tax Benefits | Available under ELSS (Equity Linked Savings Scheme) |

Business News

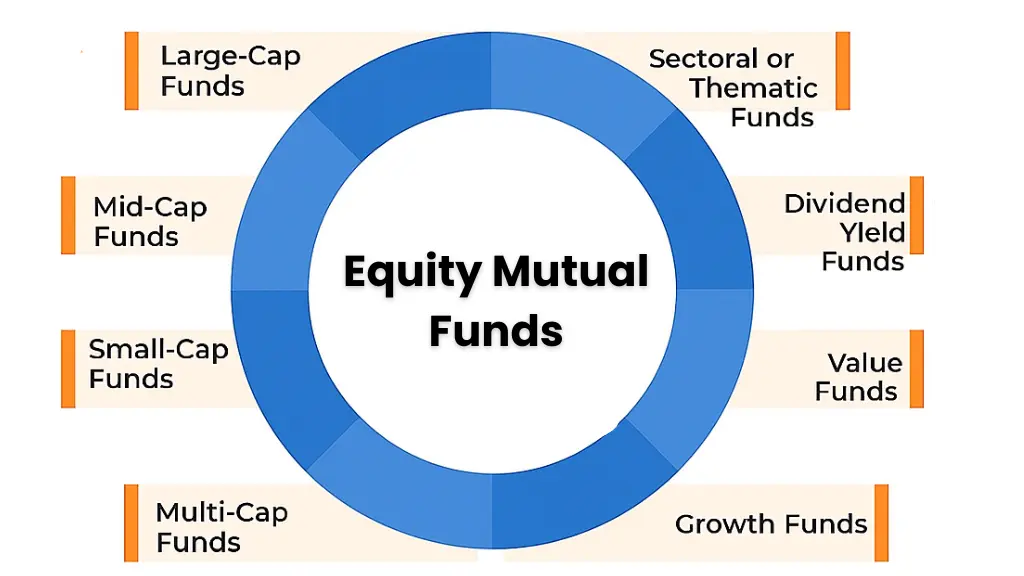

Types of Equity Mutual Funds in India

One of the main reasons why people search types of equity mutual funds in India is because equity funds come in various categories, each catering to different risk appetites and investment goals.

Large-Cap Equity Mutual Funds

- These funds invest predominantly in large, well-established companies that are leaders in their industries. Large-cap companies tend to be more stable and less volatile than smaller companies. So, large-cap equity funds are ideal for conservative equity investors looking for steady, long-term growth.

Mid-Cap Equity Mutual Funds

Mid-cap funds invest in medium-sized companies that have the potential for higher growth than large-cap companies. However, they are riskier and more volatile. If you have a higher risk appetite and a long-term horizon, mid-cap equity mutual funds can help you tap into this growth potential.

Small-Cap Equity Mutual Funds

Small-cap funds focus on companies with smaller market capitalisation. These funds can deliver spectacular returns during market upswings but can be equally volatile when markets fall. They’re best suited for aggressive investors who understand the risks.

Multi-Cap and Flexi-Cap Equity Mutual Funds

These funds invest across large-cap, mid-cap, and small-cap stocks, offering the best of all worlds. The fund manager can dynamically adjust allocations based on market conditions. Flexi-cap funds became popular after SEBI introduced new guidelines that gave fund managers more freedom to switch between market caps.

Types of Equity Mutual Funds

| Type of Fund | Description |

|---|---|

| Large Cap Funds | Invest in top 100 companies by market capitalization |

| Mid Cap Funds | Invest in mid-sized companies (101–250 rank) |

| Small Cap Funds | Invest in small and high-growth companies (251 and beyond) |

| Multi Cap Funds | Invest across large, mid, and small caps |

| ELSS (Tax-Saving Funds) | Offer ₹1.5 lakh deduction under Section 80C with 3-year lock-in period |

| Sectoral/Thematic Funds | Focus on a particular sector (like IT, Pharma, Banking, etc.) |

| Value Funds | Invest in undervalued stocks with high potential for growth |

| Focused Funds | Invest in a limited number of stocks (maximum 30) |

Mutual Fund Trending News

ELSS (Equity Linked Savings Scheme)

- When people Google tax saving through equity mutual funds, ELSS often comes up. ELSS funds are unique because they allow you to claim deductions up to ₹1.5 lakh under Section 80C of the Income Tax Act. They come with a 3-year lock-in period, which is the shortest among all tax-saving options under 80C.

Sectoral and Thematic Equity Mutual Funds

- These funds invest in specific sectors like technology, pharmaceuticals, or banking. Thematic funds may focus on broader themes like consumption or infrastructure. While they can deliver impressive returns when the chosen sector or theme performs well, they’re riskier due to limited diversification.

Dividend Yield Funds

These funds invest in companies known to pay regular dividends. Investors looking for a steady income along with growth potential often find dividend yield equity funds appealing.

Why Should You Invest in Equity Mutual Funds?

There are many reasons why equity mutual funds in India have become a preferred investment option, especially for young investors and those looking to beat inflation.

- Potential for Higher Returns

Historically, equity mutual funds have outperformed traditional investment options like fixed deposits or gold, especially over the long term. While there’s no guarantee, the growth potential is significantly higher.

- Diversification Benefits

A well-diversified equity fund spreads your money across various companies, sectors, and market caps. This diversification helps reduce the impact of poor performance in any single stock or sector.

- Professional Fund Management

You benefit from the expertise of qualified fund managers who have access to market research, data analytics, and company insights that retail investors might not.

- SIP Option for Disciplined Investing

One of the best ways to invest in equity mutual funds is through a SIP (Systematic Investment Plan). It allows you to invest a fixed amount every month, regardless of market conditions. This approach instills discipline, makes market timing irrelevant, and benefits you through rupee cost averaging.

- Easy Liquidity and Transparency

Most equity mutual funds allow you to redeem your units at any time (except for ELSS). Additionally, mutual funds are regulated by SEBI, which ensures transparency and investor protection.

Risks Associated with Equity Mutual Funds

- It’s equally important to understand the risks when searching should I invest in equity mutual funds. Equity mutual funds are market-linked, so returns can be volatile in the short term. Factors like economic slowdown, political instability, interest rate changes, or global crises can impact stock prices. That’s why equity mutual funds are best suited for investors with a medium to long-term horizon — ideally, 5 years or more.

- Trying to time the market can backfire. Instead, stay invested, review your portfolio periodically, and stick to your financial plan.

How to Choose the Best Equity Mutual Funds in India

- When you search best equity mutual funds in India, you’ll find many rankings and lists. But how do you really choose one that works for you?

- Start by defining your goal. Are you investing for wealth creation, children’s education, buying a home, or retirement? Next, consider your risk appetite. A young investor with a high risk tolerance may prefer mid-cap or small-cap funds, while a conservative investor might stick to large-cap funds.

- Look at the fund’s past performance, but don’t just chase returns. Also, check the fund manager’s track record, the fund’s expense ratio, portfolio composition, and consistency in performance during market ups and downs.

- Reading the scheme information document (SID) can help you understand the fund’s objective, risk level, and strategy. If you’re still confused, it’s always wise to consult a financial advisor.

Taxation on Equity Mutual Funds

- Taxation is a crucial factor for every investor. In India, if you hold your investment in equity mutual funds for more than one year, any gain above ₹1 lakh is taxed as long-term capital gains (LTCG) at 10%. If you sell before one year, short-term capital gains (STCG) are taxed at 15%.

- The good news is that long-term capital gains tax is lower than regular income tax rates, making equity mutual funds tax-efficient over time. Additionally, if you invest in ELSS funds, you get a tax deduction up to ₹1.5 lakh under Section 80C.

| Type of Gains | Holding Period | Tax Rate |

|---|---|---|

| Short Term Capital Gains (STCG) | Less than 1 year | 15% |

| Long Term Capital Gains (LTCG) | More than 1 year | 10% on gains exceeding ₹1 lakh/year |

Pros and Cons of Equity Mutual Funds

| Pros | Cons | Impact |

|---|---|---|

| High return potential | High market risk |

|

| Diversified portfolio | Can be volatile in short term |

|

| Tax-efficient in long term | Requires long holding period |

|

| SIP options for all income levels | Returns not guaranteed |

|

Tips for First-Time Investors in Equity Mutual Funds

- Investing for the first time? Here are a few simple tips:

- Start early. The earlier you start, the more you benefit from compounding.

- Use SIPs to invest regularly without worrying about market timing.

- Be patient. Don’t panic when markets fall; stay invested for the long term.

- Review your portfolio annually to ensure it aligns with your goals.

- Don’t put all your money in one fund; diversify.

- Stay informed but don’t get swayed by market noise.

How to Choose the Right Equity Mutual Fund?

Analyze past performance (3, 5, 10-year)

Look at expense ratio

Assess fund manager’s track record

Review portfolio diversification

Match with your financial goals & risk appetite

Final Thoughts: Should You Invest in Equity Mutual Funds?

- Equity mutual funds can be your gateway to long-term wealth creation. They offer the chance to earn inflation-beating returns while providing the flexibility of liquidity and the benefits of professional management.

- However, like any investment, they require patience, discipline, and a clear understanding of your risk appetite. If you’re someone who wants to grow your money steadily over time, equity mutual funds can be an excellent addition to your portfolio.

- Whether you’re a young professional, a family person planning for your children’s future, or someone thinking about retirement, investing in the best equity mutual funds in India could be your smartest financial decision this year.

- So, take your first step today. Do your research, set realistic goals, and let your money work for you.

- All Posts

- Become Partner

- Broker Review

- Crypto

- IPO

- Mutual Fund

- Recent News

- Recent Updates

- Stock Market

Income Tax Return Due Date AY 2025-26: Latest Updates You Must Know The income tax return due date is one...

Urban Company IPO GMP Rises Urban Company IPO GMP The Urban Company IPO GMP has surged ahead of its public...

Urban Company IPO 2025 – A Profitable Startup Going Public Urban Company IPO 2025 The Urban Company IPO 2025 has...

IPO Raised ₹599 Crore Even Before Opening, Investors Rush In; GMP Will Blow Your Mind The Indian stock market is...

Meesho Files ₹4,250 Cr IPO: India’s Social Commerce Giant Eyes Stock Market Debut in October this Year Bengaluru-based ecommerce platform...

NSE’s Diwali IPO in Sight: Awaits SEBI’s NoC After ₹1,600 Cr Record Settlement Proposal From SEBI’s Final Clearance to Damani’s...

By Popular Top Share Brokers

Motilal Oswal

30 days brokerage free trading

Free – Personal Trading Advisor

AngelOne

Free Equity Delivery

Flat ₹20 Per Trade in F&O

Profit mart

Free Equity Delivery

Flat ₹20 Per Trade in F&O

ProStocks

Unlimited @ ₹899/month

Rs 0 Demat AMC

Upstox

FREE Account Opening

Flat ₹20 Per Trade

Paytm Money

Pay ₹0 brokerage for first 10 days

Flat ₹20 Per Trade

Fyers

Free Eq Delivery Trades

Flat ₹20 Per Trade in F&O